Much of last week was spent debating whether we are in a recession, after Thursday’s GDP Report revealed that economic growth had fallen for the second quarter in a row. The White House argued that this isn’t a recession but a “transition,” while critics on the Right accused President Biden of gaslighting.

But this whole debate is a distraction from the conversation we should be having. Instead of arguing over the definition of a recession, we should be talking about something much more pressing: the ongoing energy crisis.

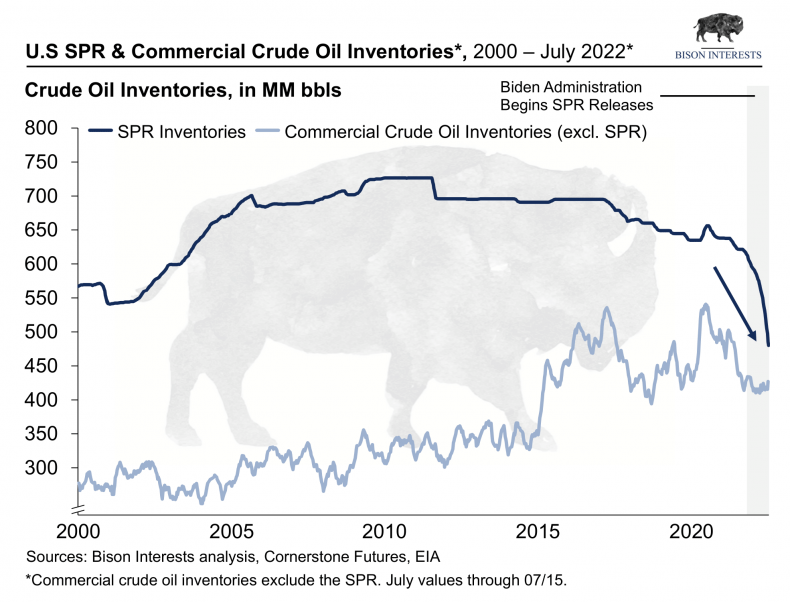

It’s actually worse than a distraction; in trying to fix inflation, the Biden administration is making the energy crisis worse. Consider the Biden administration’s decision to release huge quantities of oil from the Strategic Petroleum Reserve (SPR) to bring down gas prices. Not only has this failed to impact the price of gas in any significant way, but it’s making us less secure. What we should be doing is permitting oil wells and fast-tracking pipelines to ensure a steady supply into the future.

Or consider the Federal Reserve’s decision to raise interest rates aggressively in an attempt to cool off the overheated economy and address inflation. This is exactly the opposite of what it should be doing: stimulating investment in energy, which is necessary to keep the lights on and the air conditioning running.

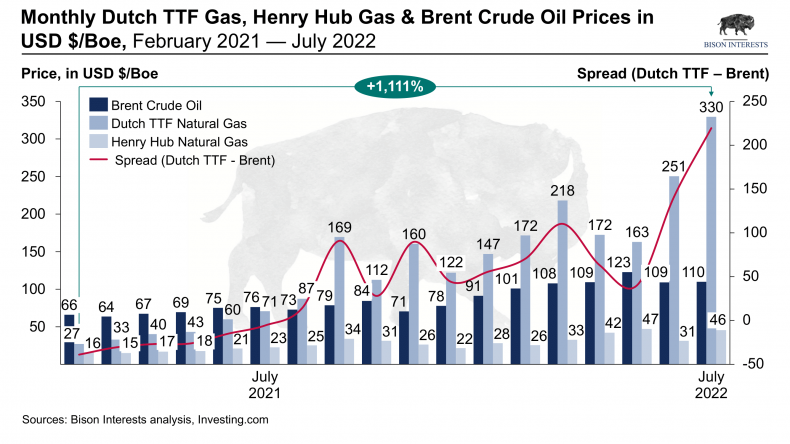

We don’t have to look far to see the consequences of these failing policies. Europe had been acclaimed for their “progress” in the energy transition and is now running out of natural gas heading into winter. European electricity prices have skyrocketed to all-time highs, and as a result, countries may have to ration energy supplies.

The situation is so dire that Deutsche Bank recently issued a warning, that Germans will have to burn wood to stay warm this winter! European natural gas is several times the price of a barrel of oil and ten times the cost of natural gas here in the U.S., despite the usefulness of oil products for transportation.

Meanwhile, Austria and France are directing their industries and utilities to upgrade their facilities so they will be capable of burning crude oil for power, reflecting the price disconnect and risk of further natural gas supply disruption. Other European and Asian countries aren’t far behind, having burned up to two million barrels per day of oil and oil products for heat and power last winter, and potentially burning up to five million this winter.

We are also at risk of the energy crisis and the conflict with Russia cascading into an oil crisis. The SPR releases are slated to end in October, shortly before Europe and Asia start burning oil for power and heat, and shortly after OPEC+ production quotas stop growing by hundreds of thousands of barrels per day, every month.

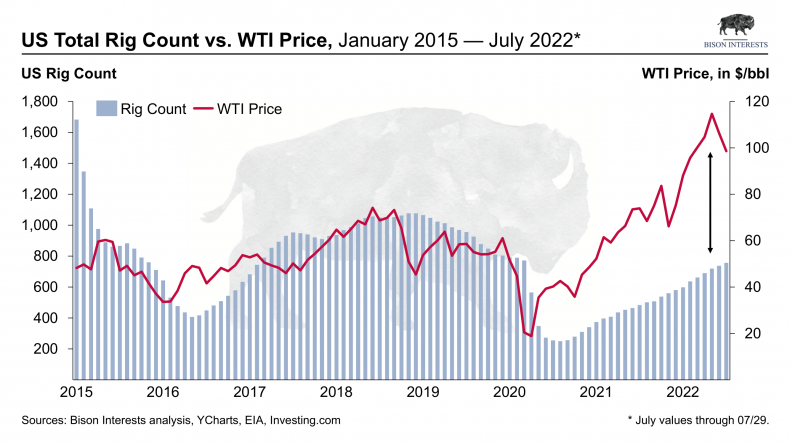

At the same time, ESG-driven divestment from our domestic oil and gas industry, along with a heavy regulatory burden and limited pipeline and drilling permits, has opened a near record gap between the oil price and the number of drilling rigs active here in the U.S.

The lack of oil supply growth despite much higher oil prices is an unforced policy error. And the European and Asian energy crisis is about to exacerbate the oil shortage, potentially sending oil prices much higher and limiting supply in a new oil crisis.

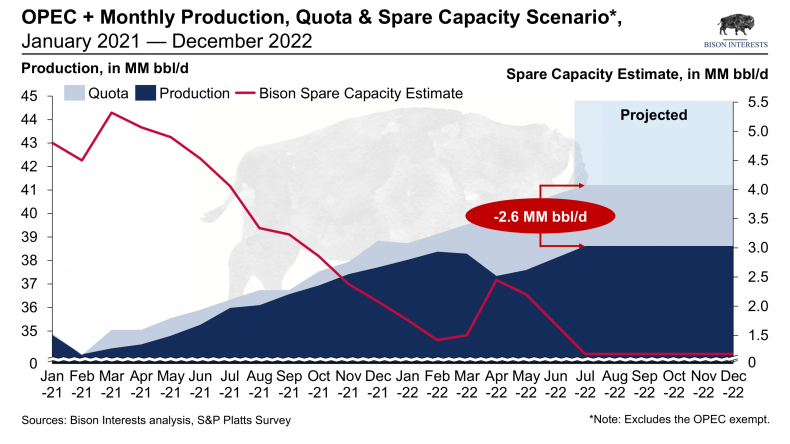

Our leaders seem to think that OPEC+ could “turn on a valve” and produce more oil for America and the world. Unfortunately, it should have been no surprise the Saudis didn’t agree to supply more oil when Biden visited.

OPEC+ is close to out of spare capacity, potentially leaving a 2.6 million barrel per day oil market deficit when it is needed most, potentially exacerbating the oil crisis and the energy crisis.

There is no safety valve for this emerging oil crisis, and OPEC+ is certainly not it.

And yet, as the energy crisis evolves into an oil crisis, the Federal Reserve and central banks around the world are raising interest rates and choking off capital that could be used for investment to fund oil production and infrastructure development and to rebuild desperately needed additional supplies.

And Biden-administration regulations aren’t helping, with pipelines and leases cancelled on his first day in office, and repeated rhetoric claiming the oil industry is “going away”—not exactly a call for further investment in the oil industry!

Anna Moneymaker/Getty Images

Despite the likely negative impacts on the economy and our standard of living, the looming oil crisis presents an opportunity to re-invigorate the U.S. economy. Our country’s energy sector is depressed, and there is an opportunity to increase the drilling rig count materially, ramp up production, and bring back the hundreds of thousands of jobs that were lost in the sector. Doing so would likely bring down oil and gasoline prices at the pump and help alleviate the rampant inflation which has been hurting American consumers.

It goes without saying that the above cannot happen without stimulating new investment from the private and public sectors. To attract new capital, policymakers must reduce the regulatory burden on companies operating in the oil and gas sector and could stimulate our economy by incentivizing new investment.

If our leaders can shift from being hostile to being supportive, depressed valuations and private capital allocation in the oil and gas sector could normalize, attracting capital to produce more energy and to suppress inflation.

The magic of the 1980s economic boom and inflation collapse wasn’t Volker; it was Reagan cutting taxes and regulations.

Josh Young is the founder and CEO of Bison Interests, an investment fund focused on publicly traded oil and gas stocks.

The views expressed in this article are the writer’s own.